| ||||

|

| ||||

Fixed vs. Variable Interest RatesBy Mark Kantrowitz Private student loans are often available with fixed and variable interest rate options. What are the differences between fixed and variable interest rates? How do you choose between a student loan that offers a fixed interest rate and a student loan that offers a variable interest rate?

Fixed Interest RatesA fixed interest rate does not change over the life of the loan. The loan payments on a fixed-rate loan will be the same every month, assuming level amortization. This provides the borrower with the security and stability of a consistent monthly loan payment that will not change. Fixed-rate loans tend to have shorter repayment terms in a rising interest rate environment. Shorter repayment terms yield a lower fixed interest rate. Keeping the repayment term short allows the lender to offer a fixed rate that is not too much higher than the current variable interest rate. It also limits the risk to the lender that the cost of funds may increase too much.

Variable Interest RatesA variable interest rate can change on a monthly, quarterly or annual basis. Variable interest rates may increase or decrease, depending on changes in prevailing interest rates. The loan payments on a variable-rate loan are less predictable, because the loan payments will change when the interest rate changes. If interest rate increases, the monthly loan payment will increase, putting more pressure on the borrower's budget. A one percentage point increase in the interest rate on a variable-rate loan can increase the monthly loan payment by as much as 5% on 10 year term, 10% on 20-year term and 15% on 30-year term. To provide borrowers with more predictability, some variable interest rates set limits on changes in the interest rate.

Variable Interest Rates Pegged to Index RatesVariable interest rates are typically pegged to a variable index rate, such as the LIBOR (London Interbank Offered Rate) index, Prime Lending Rate (the interest rate provided to a bank's best credit customers) or 10-year Treasury, plus a fixed margin. Most private student loans provide interest rates that are pegged to the LIBOR index because the lender's cost of funds are also pegged to the LIBOR index. Using the same index rate for both yields a predictable spread between interest income from borrowers and the cost of funds, simplifying the lender's finances. Variable-rate loans tend to offer longer repayment terms than fixed-rate loans, because the lender spread remains unchanged despite changes in the index rate.

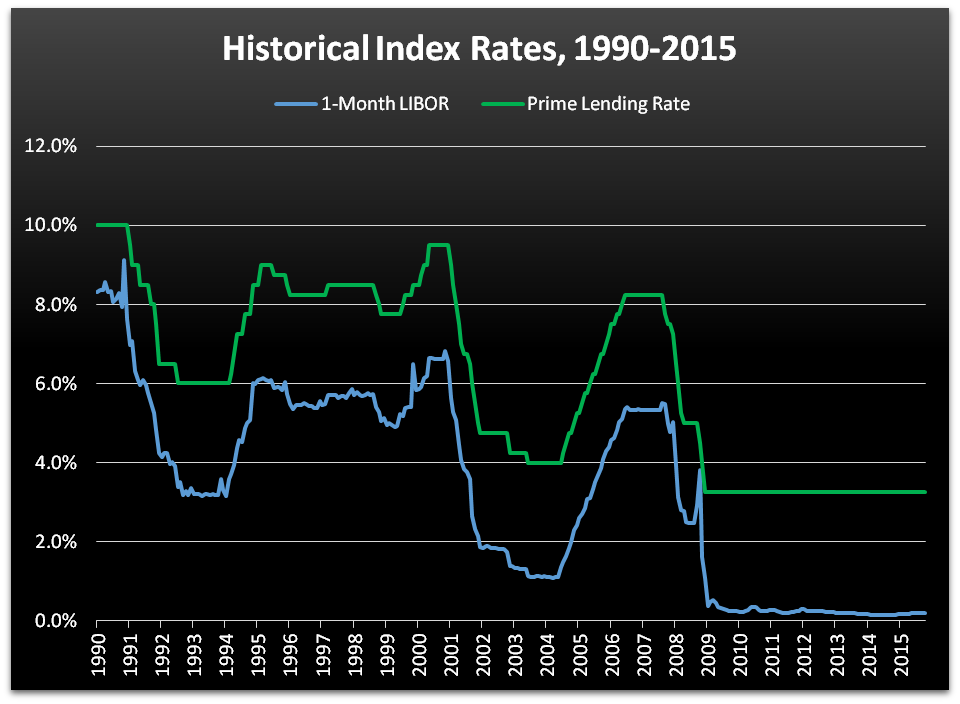

Likely Increases in Variable Interest RatesCurrently, interest rates are at historic lows, so variable interest rates have nowhere to go but up. The history of the 1-month LIBOR index and the Prime Lending Rate is shown in this graph.

Variable interest rate indexes are influenced by the Federal Funds rate, which has been unchanged at 0.25% since December 16, 2008. Although the Federal Reserve Board will introduce a 0.25% increase in the Federal Funds rate when it begins increasing interest rates again, it will likely be the start of a series of increases. The last time the Federal Reserve Board increased interest rates, it raised interest rates by a quarter of a percentage point a total of 17 times from June 2004 to June 2006, a total increase of 4.25 percentage points.

Comparing Fixed and Variable Interest RatesGenerally, a fixed interest rate will be higher than the corresponding variable interest rate in a rising interest rate environment. Borrowers sometimes get confused about the difference in the current interest rates, picking the variable-rate loan because the current interest rate is lower. In effect, they treat the variable interest rate as though it were a fixed interest rate. But, lenders price fixed and variable-rate loans to yield the same income to the lender, based on models that predict a range of future changes in interest rates. Assuming a rising interest rate environment, a fixed interest rate on a new loan with a 10-year repayment term will generally be 3 or 4 percentage points higher than the current variable interest rate. There are two scenarios in which a variable interest rate is better than a fixed interest rate.

If interest rates are rising and are expected to continue rising, it may be best for a borrower with a variable-rate loan to refinance the loan into a fixed-rate loan before the interest rates start rising.

| ||||

|

|

||||

|

||||